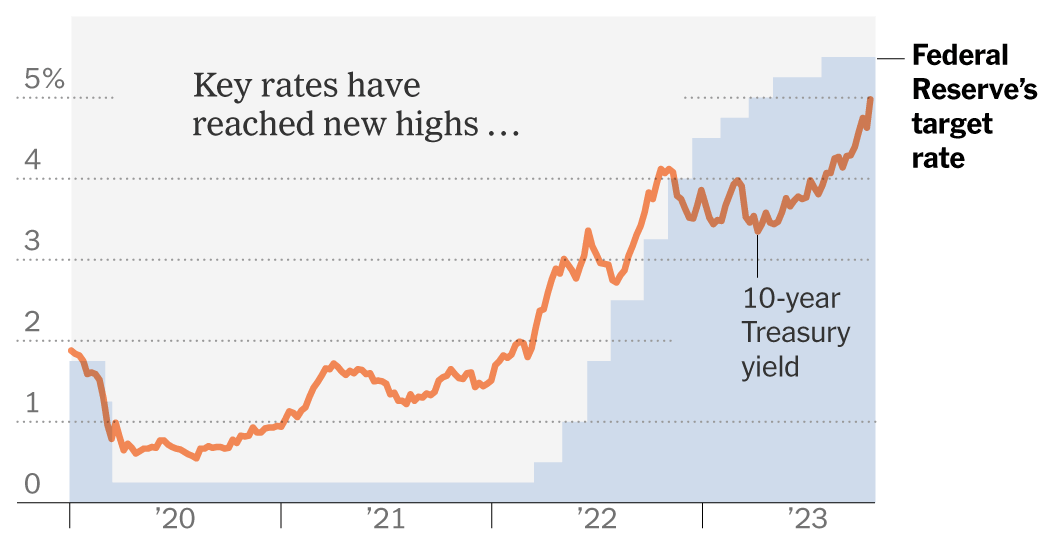

Home buyers, entrepreneurs, and public officials are facing a new reality: the wait for lower borrowing costs is going to be longer than expected. As market-based measures of long-term borrowing costs continue to rise, it is becoming clear that the economy may experience a sharper slowdown.

This trickle-down effect is impacting everyone. Small businesses, in particular, are feeling the credit crunch. Banks are facing increased expenses and are passing on those costs to borrowers, resulting in higher interest rates. This affects entrepreneurs like Liz Field, who borrowed money to open a bakery. As interest rates rise, her monthly payments have increased, leading to financial strain and potential job cuts.

This trend is also affecting farmers and consumers. The high cost of capital is making it difficult for farmers to invest in new equipment, while rising mortgage rates are keeping potential homeowners from purchasing properties. Moreover, the persistent high interest rates are causing concerns for renters in the future as fewer properties are being built.

Overall, the impact of high interest rates is far-reaching, impacting businesses, individuals, and the overall economy. While some wealthier individuals may be able to weather the storm, those who rely on borrowing and have limited resources face significant challenges.

Unique Perspective:

As interest rates continue to rise, it is crucial for individuals and businesses to adapt to the new financial landscape. This may require being more cautious with borrowing, seeking alternative financing options, or finding creative solutions to navigate the challenges posed by higher interest rates. Additionally, policymakers should consider ways to support small businesses and individuals who are most vulnerable to the impact of rising borrowing costs.